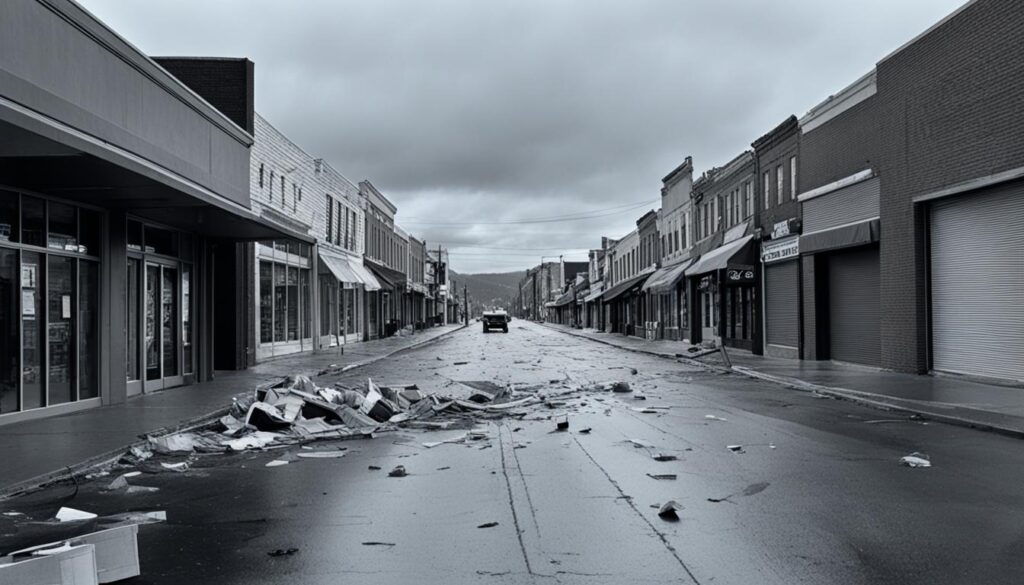

As we grapple with the profound uncertainties of our economic landscape, it’s easy to feel overwhelmed. Many are facing challenging decisions that echo through their lives, whether it’s rethinking career paths, navigating unexpected job losses, or simply trying to make ends meet. The economic crisis of 2024 has affected nearly everyone, causing stress and hardship in families and communities across the nation. This exclusive interview holds the promise of revealing insider details on the latest economic crisis, offering a glimpse into the intricate web of challenges that have reshaped industries and impacted livelihoods. With firsthand narratives from key players, we will dive deep into their experiences, illuminating the often-unseen struggles and triumphs in a time of financial turmoil. Moreover, this interview will shed light on the potential strategies and solutions being considered at the highest levels of government and industry. It will also explore the interconnectedness of the economic crisis with other major events, such as the ongoing global pandemic and the fallout from a major political scandal. By delving into these interconnected issues, we hope to provide a comprehensive understanding of the complexities at play and offer insights that can help individuals and communities navigate the current challenges.

Join us as we explore the intricate dynamics of this economic crisis, understanding not just the numbers but the human stories behind them, and what the future might hold for us all.

Key Takeaways

- This exclusive interview dives into the personal experiences of those affected by the economic crisis 2024.

- Firsthand accounts provide insights into the challenges faced by families and communities.

- Key players share their views on the current financial landscape and what lies ahead.

- The article aims to highlight not just economic data but the human stories behind the statistics.

- Understanding the ongoing crisis is crucial as it permeates various sectors.

The Landscape of the Current Economic Crisis

The current economic crisis presents a challenging landscape for many. The data indicates a sharp decline in essential growth indicators as inflation soars. Recently, the unemployment rate hit 4.3%, the highest level seen since late 2021, contributing to fears of an impending economic downturn. As job growth slows—only 114,000 new positions added compared to the previous month’s 179,000—many Americans face increased financial instability.

Consumer confidence continues to take a hit. With prices approximately 19% higher than pre-pandemic levels, households struggle to maintain stability. Rising costs impact spending habits, further exacerbating the economic downturn. The situation is underscored by ongoing protests against the conditions fostered by this financial instability. In recent demonstrations, at least nine individuals lost their lives at the hands of security forces, while additional incidents resulted in injuries and arrests. Such events signal frustration with the government’s handling of the current economic crisis, raising concerns about social unrest.

Understanding the Financial Meltdown

The current financial meltdown reflects a complex interplay of several critical factors impacting the global economy. A sharp rise in inflation, rising interest rates, and surging living costs are contributing to an alarming economic recession. The Federal Reserve’s aggressive monetary policy, highlighted by an astounding 11 rate hikes since 2022, has escalated borrowing costs, stifling consumer spending and investment.

Mass demonstrations in various regions illustrate the public’s frustration as issues related to economic hardship intensify. Reports have emerged of over 300 arrests and several fatalities during these protests, exposing the severity of the market crisis. Citizens vent their anger over food shortages and allegations of corruption while facing increasing insecurity and hunger. In regions heavily impacted by these challenges, curfews have been imposed in multiple states as fears of violence grow amidst calamity.

Conversations about the lasting effects of the financial meltdown indicate that both households and businesses grapple with unprecedented challenges. As economic conditions deteriorate, the necessity for effective governance and fiscal responsibility becomes glaringly evident. The underlying causes of the unrest point to the urgent need for solutions that not only address immediate consumer concerns but also lay the groundwork for a more stable economic future.

Insights into Wall Street Turmoil

The ongoing Wall Street turmoil reflects a significant shift in the sentiment of investors. Concerns around corporate earnings have contributed to fluctuating stock market performance, sparking anxiety among market participants. Economic stability remains uncertain, which in turn diminishes investor confidence. Recent trading patterns have illustrated this change, as analysts note continuous volatility unless clearer recovery signs appear.

In light of the current environment, several factors contribute to the prevailing sense of discontent:

- Increased volatility in stock market prices.

- Heightened concerns about economic growth and inflation.

- Shifts in consumer spending, impacting overall economic health.

As investor confidence wavers, the repercussions of Wall Street turmoil extend beyond just financial reports. These dynamics play a critical role in shaping market trends and influencing investment decisions. The next few months will be crucial for determining whether the turbulence subsides or leads to more significant implications for the stock market.

| Factors Affecting Investor Confidence | Impact on Stock Market |

|---|---|

| Corporate Earnings Reports | Fluctuating stock prices, increased sell-off |

| Consumer Spending Trends | Decreased market activity, lower valuations |

| Geopolitical Events | Market instability, risk aversion |

| Interest Rate Changes | Higher borrowing costs, dampened investor appetite |

Understanding these intricate relationships is essential for navigating the complexities of today’s financial landscape.

The Role of Government Intervention

Government intervention is essential in addressing the ongoing economic crisis. As the financial landscape continues to evolve, policymakers are implementing various fiscal policy measures to stabilize the economy. These economic measures aim to alleviate the burden on consumers and businesses affected by the crisis.

In recent discussions, the potential for stimulus packages has garnered considerable attention, reflecting the need for urgent action. Nonetheless, the complex political climate poses challenges to prompt implementation. Striking a balance between supporting struggling sectors and managing inflation becomes increasingly crucial. A well-thought-out approach is necessary to ensure measures are effective without worsening existing challenges.

The necessity for government intervention in times of economic distress cannot be overstated. By strategically employing fiscal policy tools, leaders can aim to restore confidence in markets and foster stability, laying a foundation for recovery in the long term.

| Type of Economic Measure | Impact | Examples |

|---|---|---|

| Fiscal Stimulus | Increases demand; supports jobs | Tax breaks, direct payments |

| Monetary Policy | Encourages lending; reduces borrowing costs | Lower interest rates |

| Regulatory Changes | Promotes fair competition; protects consumers | Revised financial regulations |

| Targeted Support | Assists struggling sectors directly | Grant programs for small businesses |

This table summarizes the types of economic measures employed, highlighting their impacts and providing concrete examples of how government intervention influences recovery strategies.

Exclusive Interview: Insider Details on the Latest Economic Crisis

In times of economic turmoil, understanding the insights of industry insiders proves invaluable. As key players navigate the current landscape, their perspectives can shed light on the ongoing economic downturn. Reports indicate that indices like the S&P 500, Nasdaq, and Dow have seen drops of 1.4%, 2.3%, and 1.2%, respectively. Weakening jobs, manufacturing, and construction data contribute to these fluctuations.

Key Players in the Economic Downturn

Leading organizations are feeling the strain of the market shift. Apple recently announced a second consecutive quarter of falling iPhone revenue. Amazon has predicted lower-than-expected revenue growth while planning increased investments in AI services. Furthermore, Intel’s intention to lay off thousands highlights the ongoing struggle within the tech sector. Financial analysts underscore the fact that movements among these key players reflect broader trends impacting the economy.

What Insiders Are Saying

Insider insights reveal deep concerns regarding consumer spending and market stability. The 10-year Treasury yield dropping below 4% for the first time since February signals investors’ uncertainty. The Bank of England’s reduction of its key interest rate to 5% showcases attempts to stimulate growth amidst these challenges. Moreover, the recent protests and unrest surrounding food shortages and accusations of corruption in Nigeria reveal the direct correlation between public sentiment and economic health. The potential for escalated violence adds to the already heightened anxiety among investors.

Bailout Negotiations and Their Implications

As the economic climate grows increasingly uncertain, bailout negotiations are taking center stage in discussions among policymakers and industry leaders. These negotiations aim to distribute vital financial assistance across various sectors impacted by the unfolding crisis. Efforts focus particularly on small businesses, which often serve as the backbone of local economies, along with larger industries facing significant downturns.

The prospects for successful economic recovery hinge on the outcomes of these discussions. Governments need to balance the urgency of assistance with the long-term implications of their decisions, as poorly crafted solutions could lead to further instability in the market. Strong advocacy for specific sectors underscores the complexity of the negotiation process, highlighting not just the immediate need for funds but also the importance of sustainable practices moving forward.

In light of recent setbacks, navigating this landscape requires deft negotiation skills that can account for a variety of stakes. As stakeholders work to secure a path towards economic stability, the ramifications of these bailout negotiations will become evident in both the short and long term.

| Sectors Targeted for Financial Assistance | Impacts of Negotiations | Long-term Implications |

|---|---|---|

| Small Businesses | Immediate liquidity support | Stabilization of local economies |

| Energy Sector | Job retention and growth | Transition towards sustainable practices |

| Large Industries | Preventing widespread layoffs | Market confidence and stability |

The Factors Leading to the Economic Recession

Multiple elements contribute to the emerging economic recession, with high interest rates significantly impacting various sectors. The Federal Reserve’s recent monetary policy actions have escalated borrowing costs, forcing consumers and businesses to reconsider spending and investment choices. Consequently, the implications of these financial changes heighten apprehensions about the economic landscape.

High Interest Rates and Their Impact

The deliberate increase in interest rates aims to combat inflation, but it carries unintended consequences for the broader economy. Borrowing becomes costlier, resulting in a noticeable decline in consumer spending on major purchases such as homes and cars. Businesses face similar constraints, as higher financing costs may curb expansion plans or push them to delay critical investment projects. These factors lead to an overall slowing economic momentum, exacerbating fears of a deepening economic recession.

Job Market Trends Amid the Crisis

Current job market trends reveal a worrying trajectory. Rising unemployment rates reflect the consequences of high interest rates as companies scale back hiring or implement layoffs. Stagnant wage growth further exacerbates the economic situation, making it difficult for many workers to maintain their living standards. The interplay between these job market trends and the overall economic climate indicates a challenging period ahead, compelling workers and companies to adapt to a rapidly changing landscape.

The Significance of Quantitative Easing

Quantitative easing emerges as a crucial tool within monetary policy aimed at reviving economic growth during downturns. This strategy allows central banks to inject liquidity into the financial system, which can stimulate spending and investment. As the economy faces challenges like declining demand and high inflation, adjusted monetary policies become essential.

The implementation of quantitative easing involves the purchase of various financial assets, primarily government bonds. These actions reduce interest rates and facilitate easier access to credit. Consequently, businesses and consumers find it easier to borrow, supporting overall economic stability and growth.

Quantitative easing has significantly transformed fixed income markets. For instance, at the beginning of the century, less than 90 exchange-traded funds (ETFs) existed with total assets of around $70 billion. By 2022, bond ETFs attracted $245 billion in investor money, despite the asset class facing its challenges. Now, fixed income ETFs represent a $2 trillion asset class.

| Year | Bond ETF Assets (in billions) | Market Trends |

|---|---|---|

| 2000 | 70 | Low ETF penetration |

| 2014 | 143.4 | PIMCO Total Return Fund leads |

| 2022 | 245 | High investor interest |

| 2024 | 320.1 | Vanguard Total Bond Market Index Fund |

As quantitative easing remains integral to monetary policy, striking a balance is essential to mitigate long-term risks, including the potential increase in national debt. This approach can reshape the economic landscape, fostering growth and enhancing financial market liquidity, which benefits a broader range of investors.

How Stimulus Packages Are Affecting the Economy

Stimulus packages represent a vital aspect of the government’s response to the ongoing economic crisis. As various sectors face unprecedented challenges, these economic stimulus measures aim to provide immediate financial relief to individuals and businesses affected by the downturn. With discussions surrounding new initiatives, it’s essential to understand the implications on the economy.

Recent evaluations of earlier stimulus packages indicate a mixed response from the public and markets. The government’s intent to create effective programs has contributed to a sense of consumer optimism, yet inflationary pressures have become a significant concern. The balance between delivering timely relief and managing potential long-term consequences remains a focal point for policymakers.

When assessing the impacts of the economic stimulus, several factors emerge:

- Immediate assistance to low-income households and unemployed individuals can stimulate consumption, driving economic activity.

- Businesses receiving funds often experience improved cash flow, enabling them to retain employees and operate at full capacity.

- The potential for inflation increases as substantial funding enters the market, causing prices to rise and impacting purchasing power.

The market’s reaction to the government’s stimulus measures highlights diverse opinions among investors. Analysts are keeping a close eye on the ongoing developments to gauge their impact on recovery. The successful implementation of these packages stands as a critical factor for the sustainability of economic growth amidst challenging times.

| Indicator | Current Status | Implications |

|---|---|---|

| Consumer Sentiment | Improved | Encourages spending and investment |

| Inflation Rate | Increasing | Potential erosion of purchasing power |

| Employment Rates | Stagnant | Need for job growth measures |

| Business Confidence | Mixed | Investment strategies in flux |

The dialogue surrounding stimulus packages continues to evolve. It remains imperative for stakeholders to remain adaptive and keenly aware of both the short-term benefits and the broader economic implications of these financial relief efforts. As conversations unfold, the potential for meaningful recovery hangs in the balance, reliant on effective government action paired with resilient market conditions.

The Rise in Bankruptcy Filings

The increasing number of bankruptcy filings highlights significant economic challenges impacting small businesses across the nation. As rising costs and decreasing consumer spending continue to strain their operations, many small enterprises find themselves unable to sustain profitability. This troubling trend not only threatens these individual businesses but also poses a broader economic impact on local communities and employment rates.

What It Means for Small Businesses

The implications of bankruptcy filings extend deeply into the fabric of small businesses. As these establishments struggle, several key factors come into play:

- Job Losses: Increased insolvency often leads to layoffs, driving up unemployment rates and reducing disposable income within communities.

- Loss of Services: The closure of small businesses diminishes local services and retail options, impacting community life.

- Decrease in Local Revenue: Local economies suffer from reduced tax revenues, hindering public services and infrastructure projects.

- Impact on Competition: A contraction in the number of small businesses limits competition, potentially leading to higher prices and decreased innovation.

Statistics reflect these economic realities. With unemployment rising to 4.3%, and major corporations like Intel announcing substantial workforce reductions, the pressure on small businesses intensifies. Additionally, market fluctuations indicate instability worldwide, affecting banks, technology companies, and manufacturing sectors.

The rise in bankruptcy filings signals a pressing need for intervention and support mechanisms to assist small businesses in navigating this challenging landscape. Without strategic measures, the long-term economic stability of communities facing these downturns may be severely compromised.

| Indicator | Impact |

|---|---|

| Unemployment Rate 4.3% | Higher job losses and reduced consumer spending |

| Major Job Cuts (e.g., Intel 15%) | Increased financial strain on local economies |

| Decline in Manufacturing Activity | Direct effects on small business supply chains |

| Banking Instability | Impact on lending availability and business finance |

Future Projections for the Economy

As analysts assess the landscape, economic projections vary significantly based on the underlying factors influencing recovery. Some experts express concern about the potential for a sustained recession, while others suggest that innovative business strategies and effective government policies could lead to a more favorable recovery outlook. The divergence in opinions emphasizes the complexity of current market trends.

Key indicators such as employment rates and inflation will play pivotal roles in shaping the overall economic landscape. Analysts recommend close monitoring of these indicators to adapt strategies accordingly. For instance, organizations that embrace agility will likely fare better in navigating uncertain economic waters.

As the economic situation evolves, various sectors may experience different growth trajectories. Here is an overview of expected trends:

| Sector | Projected Growth Rate (%) | Key Factors |

|---|---|---|

| Technology | 5.4 | Increased remote work demand |

| Healthcare | 4.8 | Focus on telehealth and wellness |

| Retail | 3.2 | E-commerce expansion |

| Manufacturing | 2.7 | Supply chain adjustments |

| Hospitality | -1.2 | Travel restrictions |

The mixed market trends highlight the need for businesses to stay informed and responsive. Those who can leverage insights from economic projections may find opportunities even amidst challenges. Ultimately, the path to recovery will depend on strategic decisions made during this crucial timeframe.

Conclusion

The economic crisis conclusion drawn from this comprehensive analysis illustrates the multifaceted challenges currently facing nations. The summary of findings emphasizes the dire situation, as evidenced by significant downturns in major stock indices like the S&P 500 and Nasdaq. These trends reflect troubling signs within both the corporate sector—such as declines reported by major firms like Apple and Amazon—and broader economic indicators that have raised alarms amongst policymakers and financial analysts alike.

However, amid these concerns, collaboration remains vital. It highlights that a successful response to the crisis hinges on the partnership between government entities and the private sector. Essential steps must include strategies designed to stimulate growth and promote stability, crucial for navigating these turbulent times. As the roles of entities such as the Bank of England and major corporations evolve, understanding the interconnectedness of international diplomacy and economic policy will play a role in shaping the future economic outlook.

Moving forward, it is critical to closely monitor developments and adjust strategies as necessary in the wake of ongoing negotiations and interventions. By fostering a collaborative environment and prioritizing adaptive approaches, stakeholders can address these pressing concerns effectively and steer the economy towards recovery, ensuring resilience against future disruptions.